This is when the fourth self-employment grant will be paid and who can claim

The fourth Self-Employment Income Support Scheme grant has been outlined by the UK Treasury, prior to today’s (3 March) budget.

The grant has already supported millions of self-employed people across the UK, with billions being handed out to those affected by lockdown restrictions.

Advertisement

Hide AdAdvertisement

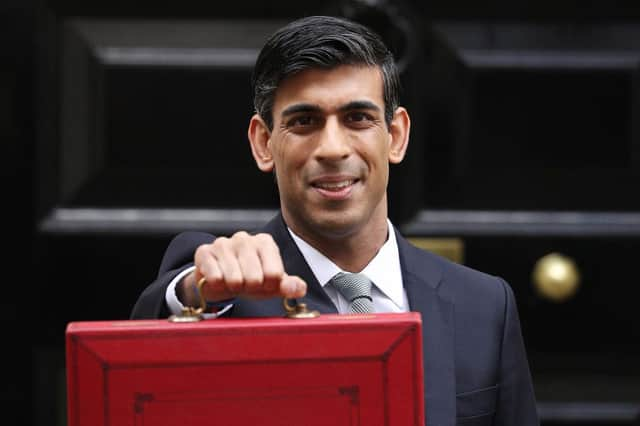

Hide AdThe UK chancellor, Rishi Sunak is expected to give more details about the support grant, though it has been confirmed that it will continue into the spring and summer.

So, how will the government support self employed people with a fourth grant and who can apply? This is what we know so far.

Will there be a fourth SEISS grant?

The Treasury has confirmed that there will be a fourth payment, supporting self-employed workers affected by coronavirus restrictions from February 2021 until April 2021.

The UK government has told how a fifth SEISS grant will also be offered, to support self-employed people as lockdown lifts.

Who is eligible to claim support from the SEISS grant?

Advertisement

Hide AdAdvertisement

Hide AdTo make a claim for the fourth grant your business must have incurred economic downturn from the impact of coronavirus, which will have caused a significant reduction to your profits.

Traders who are continuing to trade but who face restrictions which impact their profit making, or who are unable to trade are eligible to apply.

Sunak will announce than extra 600,000 newly self-employed people may be eligible to claim government support.

This is due to the government now allowing workers to submit their 2019-2020 and 2020-2021 self-assessment tax returns as evidence of their earnings.

Advertisement

Hide AdAdvertisement

Hide AdTo be eligible for the previous three grants, self-employed workers had to have traded in both 2018 to 2019 and 2019 to 2020. This is no longer the case.

HMRC’s guidance states that members of a partnership can also claim, and support will be based on their share of the partnership’s profit.

Applicants must be able to prove that they plan to continue trading, or providing a service, beyond the end of the support, which is expected to end in April.

How much is available?

The chancellor will announce that 80 percent of typical monthly earnings, up to £2,5000, will continue to be the amount claimable from a self-employed worker.

Advertisement

Hide AdAdvertisement

Hide AdTherefore, the one off grant covering the three months of February, March and April will be set a maximum of £7,500, depending on what your usual income is.

The previous three grants have also set at 80 percent, although the third grant had been initially set at just 20 percent.

The chancellor of the exchequer, Rishi Sunak, will map out all of the details during his Budget announcement, later today (3 March).

This article will be updated when more details are announced.

How do I apply?

Advertisement

Hide AdAdvertisement

Hide AdApplications are not yet open, although the government is likely to announce when you can apply in the next few days.

You can determine if you will be eligible by viewing the criteria on the Government website.

Guidance on how to submit proof of earning and how your trade has been impacted by the lockdown is available on the HMRC website.